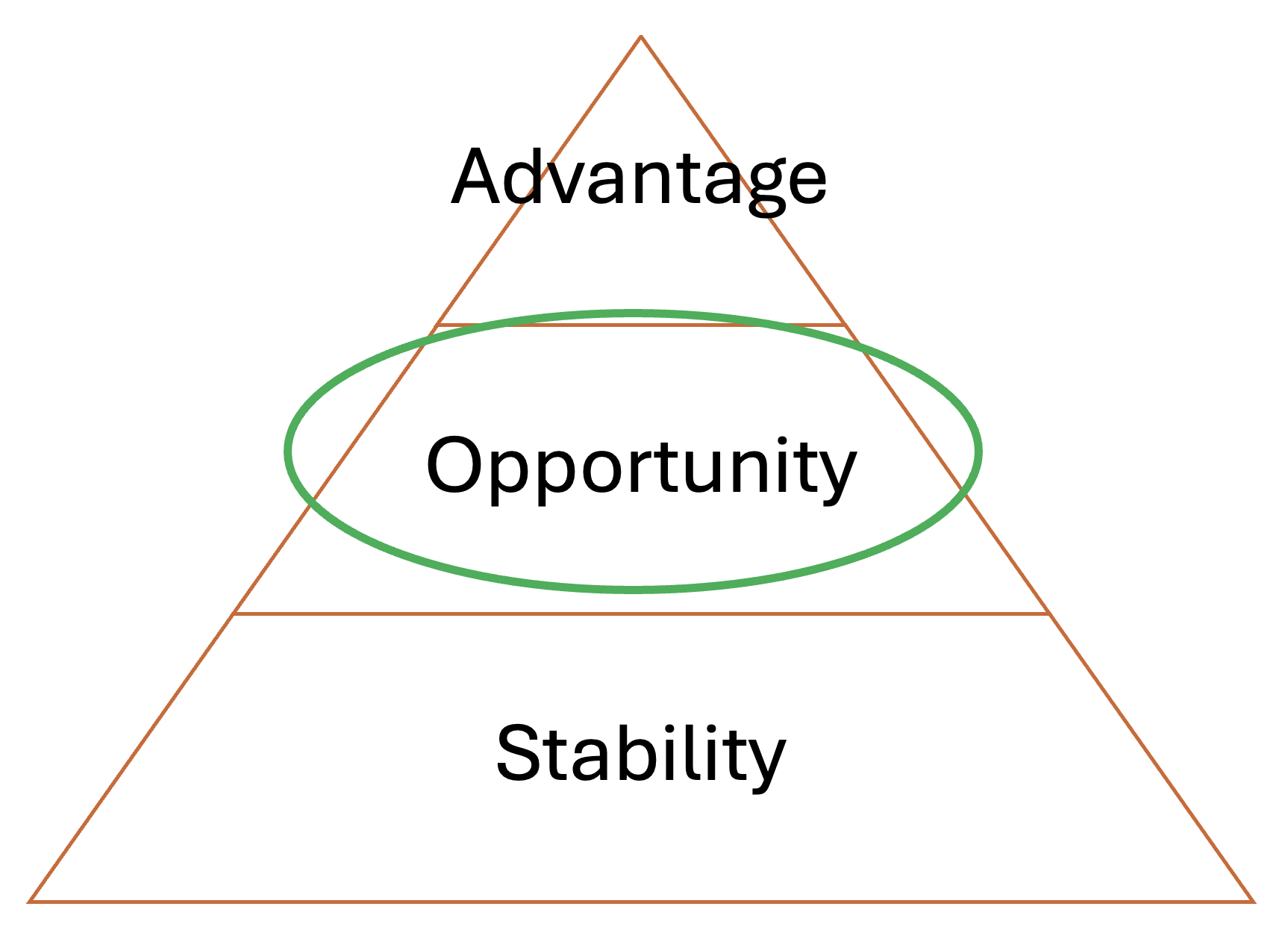

The framework for good financial decisions for expats in Europe

We recently wrote an article stressing the importance for expats in Europe to have their financial foundations in place before considering other aspects of their financial life.

In this article we are focusing on the second tier- what to do after you have set your financial foundations. We call this second tier, ‘Opportunity’.

Before we get into the details on this important ‘Opportunity’ tier, we will quickly summarise what you need to do to have your foundations – the Stability tier- in place. You can read the article about getting your financial foundation.

In brief, the 4 key actions you need to take to have your financial foundations in place are:

Cash Flow - having structure and discipline around cash flow is a first step in applying your finances to achieve your life goals, and small changes, regularly applied, can have profound impacts over time. Know and control your cash flow and you can apply this knowledge to take advantage of opportunities to realise your goals.

Emergency funds – you should aim to have an appropriate amount of cash that is accessible and can allow you to deal with unexpected expenses and emergencies.

Goal Clarity – you need to have this worked out before you consider investing. Take your time to consider what is most important to you. Writing down your goals and from these we can quantify targets.

Risk Coverage -this is protection for you and your family against events that can otherwise derail your international life. This may be house insurance, it could be life insurance, or self-funded protection, in addition to emergency funds.

Opportunity - The Second Step

Once you have all the foundations in place, you can turn your focus to opportunity. Where stability is focused on protection against things going wrong and understanding what it important to you, the second stage is about taking steps to achieve those goals.

Key components include the following but there may be others, depending on what is most important to you.

Long term goal planning

This might feel like going back to goal clarity but is really focused on getting into the detail. At the goal clarity stage you are noting what is important for you, capturing your broad goals. Long term goal planning is about quantifying these targets and putting a plan of action together. If you are an international professional living abroad, your goals may change depending on where you are living. You might also need to make adjustments to any plans to make sure they remain relevant and compliant. Getting advice is important.

When we work with clients to develop their long term goal planning, we interrogate their objectives to make them measurable, time-driven, and quantifiable.

As an example, your goal may be financial independence.

What does that mean? Financial independence can mean different things for different people.

When do you want to achieve it? Do you want this to be in 5 years, 10 years, or 20 years’ time? Your time frame will impact the size of the target and the actions you take.

What is the target, quantified? Based on how you answer these questions we can calculate a target amount you need, and by when, to achieve this objective. This is your number.

You need to undertake this process for all your goals.

Once you know your target, we need to focus on how you will get there. This is a complex process with many influencing factors and we need to consider the interrelationship between your objectives and whether they are complementary or in competition.

This is a process of distillation, taking data from many sources to derive a clear action plan that will see you on the path to realising your goals.

The decision of where and how to invest, is the last part of this stage and is the means to the end. An optimal investment for one person may be different from the next.

Wealth accumulation

Wealth accumulation is the process of growing your asset- what you own- faster than the rate of inflation to move you closer to your targets. Whatever your goal, if it has a financial target, you need to grow your wealth to achieve the goal.

Wealth accumulation is an ongoing process. It requires active management and regular reviews to ensure your objectives remain on target and the investments you are utilising are appropriate for you.

As you build you wealth you have choices and as you achieve some goals you may have new ones emerge.

Retirement planning

This is important for most people, and particularly for expats in Europe it is a vital piece of your long term planning. The opportunity may arise from pension structures in the country in which you are living, or from an improved cash flow position. Defensively, you may need to cover any pension gaps, if you are living in a country where you do not receive any pension contributions.

There are important changes to the retirement landscape that will impact all of us: we are all living longer, and state supported pensions are shrinking and commencing later.

We recommend a targeted approach to retirement planning so you can take advantage of the opportunities available to you. It is important that you get professional financial planning advice to ensure you are adequately prepared.

With the same interrogative detail we described above, you need to plan for what retirement might look like.

When will you cease work?

Where will you live?

How will you live?

What do you intend to do?

Will you be eligible for pension payments?

If so, from what age?

Retirement planning is complex and we need to weigh it against the opportunity cost of meeting your short-term needs and goals.

This second tier in the pyramid of financial planning is where you get into detail so you can build your wealth and achieve your goals. It requires considered thinking and taking the time to make good decisions, but the outputs can be very rewarding.

It will then lead to the third tier, ‘Advantage’ which we will save for another article.

For more information on how to apply this to your life, speak with us. You can contact us at info@extinvestments.com.