5 reasons why expats are worried about outliving their pensions and 3 things to do about it

Retirement planning changes when you become an expat.

Most of us have accrued pensions from our employers in our home country and often in the countries we are now living as international professionals. We spend much of our working lives foregoing some income now to contribute to pension plans in the expectation it will create a comfortable retirement income in the future.

Why is outliving a pension a growing concern?

Living longer than your pension is a problem affecting more people now. We are living longer, which means our pensions must last longer than ever before and for some there is a risk their pensions will run out too soon. Plus, there is inflation to contend with, eroding the purchasing power of the income year on year.

There is an added layer of complexity if you are an expat. This is because you will either be accruing pensions across more than one country, or you may be missing out on receiving pension contributions where you currently live and work. This places a much larger onus on arranging an alternative outside the pension system.

There are five key reasons why expats are worried about their retirement income planning:

1. Longevity: Life expectancy has risen significantly in recent generations and that means pensions need to last even longer. Longer lives are clearly positive, but it does present more challenges when it comes to managing retirement finances.

See below from a recent OECD report that the average life expectancy after retirement is another 22.5 years for women and 17.8 years for men.

(Source: https://www.oecd-ilibrary.org/)

2. Potential care: Coupled with rising longevity is the concern that more of us may need some form of social care. The majority of those requiring care, whether home care services or residential care, will need to pay for at least a portion of their own care costs. These costs can be significant and should be factored into retirement plans but knowing what should be set aside is difficult.

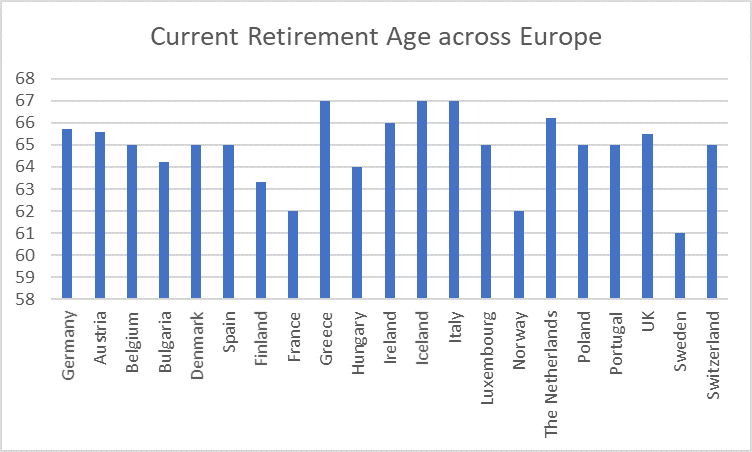

3. Global mobility: As international professionals, one of the most common themes we hear is people not knowing where they will retire. It might be back in their home country, in may be in their current residential country or it may be somewhere else entirely. This creates concerns for many expats as they consider different tax laws and pensions rules in different countries. This makes it more important to commence sooner and have as much flexibility as possible. For example, if you decide to retire in France where the legal retirement age is 62 but have worked in another country with a different designated retirement age, you might not be able to access your pension from your working country until you have reached that country’s threshold. Many countries are changing eligible retirement ages by year.

This graph illustrates the complexity, just across Europe:

4. Pension Gap: as mentioned above this can be a big issue for international professionals. It is a common occurrence that you may spend a period of your working career where you are not receiving pension contributions. The compounding impact of that absence of accrual can have a significant impact on your income when it comes to retirement. You need to address this.

5. Exchange rates: We have already mentioned different rules and regulations, but if you are also planning to receive retirement income from more than one country, depending on where you live in retirement you may find yourself having to juggle two or even three currencies. Sometimes this is unavoidable, so if it is likely it is something you need to prepare for. You need to build in buffers for changes in the exchange rate which can have a big impact on your purchasing power.

3 solutions to avoid pension problems at retirement

With so many people worried about outliving their pension, which is another way of saying being worried about not building up a sufficiently large pension investment, it’s important to look at what other ways you can resolve this problem.

They are actions that can give you greater peace of mind and lead to a financial plan that includes arrangements should something unexpected happen, providing you with a financial safety net.

1. State Pensions: First, over your years working, depending on where you have lived and worked, you may accrue some State Pension entitlements. Different countries in Europe have different rules; in the Netherlands it is 2% per year working. This should be built into your long-term planning calculations including implications of moving countries and continued eligibility.

2. Property: Property is a much-discussed asset class with expats and can potentially be a useful component of a retirement plan depending on your circumstances. Some advantages of property are that it is tangible; we can see it, it can produce dividend income in the form of rent and over the long term should also generate capital growth outpacing inflation. There are some downsides though: it is not divisible, meaning you can’t just sell a part of it if you need some capital; if you are not renting it out there is no income being generated; and there are costs of maintenance and upkeep, registration, letting and insurance.

3. Build your own retirement Investment: Take control! This is probably the most valuable, impactful and realistically doable solution. With the right advice, you can create your own retirement investment plan, developing a portfolio of growing assets being added to over time, as per a pension, but outside the pension system. At retirement, the dividend income generated can supplement your other pension income and have a big impact on your quality of life. Furthermore, should your circumstances change along the way and you need to access some capital, it is there without regulatory restriction.

Entering retirement with financial confidence

To fully enjoy retirement, confidence in your financial position is important. This is where specialist expatriate focused financial planning can add real value.

Contact us and we can help you to get on track and stay on track with your retirement goals.